This is an archive of news stories and research from the National Union of Public and General Employees. Please see our new site - https://nupge.ca - for the most current information.

Enthusiasm from Europe spreads to Canada in advance of G20 meetings planned for Toronto in June.

Ottawa (13 April 2010) - The campaign for a Robin Hood tax on global financial transactions is beginning to heat up in Canada in advance of the planned G20 meetings in June.

A grassroots lobby demanding such a tax has spread quickly throughout Europe and is gathering momentum in Canada, thanks in large part to the labour movement, which has been at the forefront of the campaign across the globe.

|

The hope is that G20 nations will treat the proposal seriously when they gather in Toronto, even though the Harper government in Ottawa (predictably, given its always close ties to big business) opposes the idea.

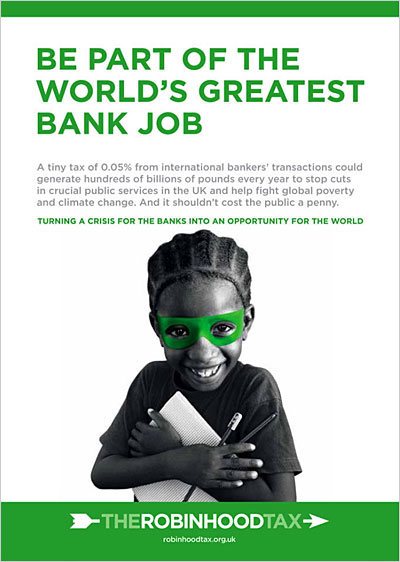

The goal of the campaign is to have G20 governments agree on the need for a minuscule tax on every trade in stocks, bonds, currencies and derivatives.

The proceeds would be put in a global fund directed at poor countries or climate change. At the same time, the levy would encourage traders to think twice before engaging in the kind of reckless behaviour that caused the global economic meltdown.

Strong case to be made

"We want to make the case for (the tax) because we think the case is extraordinarily strong," Guy Ryder, general secretary of the International Trade Union Confederation (ITUC), recently told CanWest News. The ITUC representing 175 million workers in 155 countries.

Ryder was in Vancouver to prepare for a congress of global unions in June. Canada lags other parts of the world in supporting the idea but it is important to take the idea to the people, he said.

The idea has taken off among grassroots groups in the United Kingdom, France, Germany and elsewhere in Europe. Governments there have also been receptive with France and Germany leading the way.

European Union (EU) finance ministers are discussing the idea this week, and British Prime Minister Gordon Brown is campaigning openly for the G20 to adopt some kind of tax or levy on financial risk-taking.

Even in the United States, the holy land of global capitalism, the Obama administration has not closed the door to the idea.

While the Harper government has refused to consider the idea, opposition parties are expected to be more receptive and the concept is also expected to become increasingly popular among Canadians as they learn more about it.

The European Union has estimated that a Robin Hood tax could raise about $70 billion a year. Non-governmental organizations say the amount is more like $400 billion annually.

Turning a crisis into an opportunity The National Union of Public and General Employees (NUPGE) has been one of the most active organizations in Canada calling for Canada to support such a tax.

The National Union of Public and General Employees (NUPGE) has been one of the most active organizations in Canada calling for Canada to support such a tax.

"This is an idea that NUPGE has supported for a long, long time," says NUPGE president James Clancy.

"We were supporters of the idea of a Tobin Tax on currency trading when it was first proposed many years ago.

"As the campaign for an updated Robin Hood Tax gathers momentum – and as its proponents are saying loudly and clearly to political leaders around the globe – we believe it is time to turn a crisis for the banks into an opportunity for the world. We believe it is time for action in the interest of people and the planet."

NUPGE

The National Union of Public and General Employees (NUPGE) is one of Canada's largest labour organizations with over 340,000 members. Our mission is to improve the lives of working families and to build a stronger Canada by ensuring our common wealth is used for the common good. NUPGE

More information:

• Visit Robinhoodtax.org.uk

• NUPGE endorses Robin Hood tax on big banks

• Global campaign builds for Robin Hood tax on banks