This is an archive of news stories and research from the National Union of Public and General Employees. Please see our new site - https://nupge.ca - for the most current information.

“Hopefully this report will gain some traction with the broader corporate community and we’ll have a real conversation as to how to rectify this imbalance, before it’s too late.” says James Clancy, NUPGE national president.

Ottawa (15 July 2011) - This week the Conference Board of Canada released a new report showing income inequality on the rise across the country. The report, Canada Inequality: Is Canada becoming more unequal?, suggests that over the last 20 years the poor and middle class have lost ground to the rich and super-rich.

Ottawa (15 July 2011) - This week the Conference Board of Canada released a new report showing income inequality on the rise across the country. The report, Canada Inequality: Is Canada becoming more unequal?, suggests that over the last 20 years the poor and middle class have lost ground to the rich and super-rich.

The report reiterates questions the All Together Now! campaign has been asking for over a year, "High inequality raises two questions. First, what is the impact on the economic well-being of a country? The answer is that high inequality can diminish economic growth if it means that the country is not fully using the skills and capabilities of all its citizens or if it undermines social cohesion, leading to increased social tensions. Second, high inequality raises a moral question about fairness and social justice."

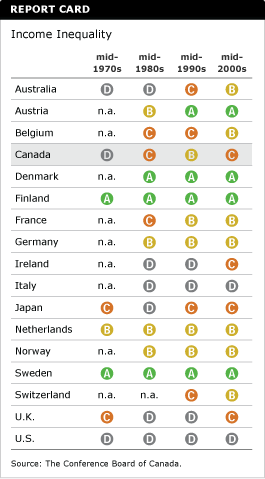

When compared to other countries, the report shows that Canada is ranked 12th in terms of income inequality and currently has a C ranking. The only years in which Canada received higher than a C grade was in the 1990’s when it earned a B ranking. As well, "Canada is the only peer country whose relative grade dropped between the mid-1990s and the mid-2000s, owing to its significant increase in income inequality (the second-largest of all the peer countries)." The United States has consistently held a D ranking while Sweden, Denmark and Finland consistently receive an A.

Specifically, the report demonstrates that income inequality is reduced when governments provide assistance through transfer and support programs such as employment insurance, social assistance, old age or child benefits. With diminishing levels of government assistance, as has taken place in Canada since the mid-90s, the result has been that the income gap has continued to widen.

When examining taxes, a similar trend has occurred. The impact on reducing personal incomes taxes has less impact now that it used to have. In fact, “Canada’s tax and transfer system is not reducing income inequality as much as it did prior to 1994. Since 1994, however, the trend has reversed. In effect, while the tax and transfer system still plays an important role in reducing income inequality, the redistributive effect of the tax and transfer system has grown weaker since 1994.”

In addition, it is noted that in Canada "the falling top marginal tax rates are part of the explanation for the rise of the richest one per cent of the population."

“It’s about time the business community woke up to the realization that there are huge implications when income inequality is allowed to flourish,” says James Clancy, national president of the 340,000 member National Union of Public and General Employees. “We’ve been making this point for a number of years but for some people, it’s still a new concept.”

“Hopefully this report will gain some traction with the broader corporate community and we’ll have a real conversation as to how to rectify this imbalance before it’s too late.”

More information:

Canada Inequality: Is Canada becoming more unequal?

NUPGE

The National Union of Public and General Employees (NUPGE) is one of Canada's largest labour organizations with over 340,000 members. Our mission is to improve the lives of working families and to build a stronger Canada by ensuring our common wealth is used for the common good. NUPGE